KaChing: A Better Alternative to Mutual Funds?

By Harry McCracken | Monday, October 19, 2009 at 3:18 am

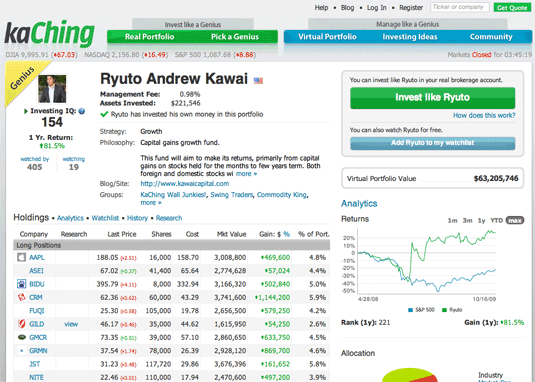

Finance site KaChing has been around for awhile, letting investors share virtual stock portfolios. Today, however, it’s launching a new version that’s meant to make a much bigger impact: It’s making the virtual portfolios real, letting members “invest like a genius” by putting their money in the same companies as amateur and professional investors who KaChing rates as having outstanding investment records, philosophies, and practices–using a formula it refers to as “Investing IQ.”

Finance site KaChing has been around for awhile, letting investors share virtual stock portfolios. Today, however, it’s launching a new version that’s meant to make a much bigger impact: It’s making the virtual portfolios real, letting members “invest like a genius” by putting their money in the same companies as amateur and professional investors who KaChing rates as having outstanding investment records, philosophies, and practices–using a formula it refers to as “Investing IQ.”

The idea is to provide an alternative to mutual funds that’s more transparent: You see the moves “geniuses” make in real time, and can dig as deeply as you like into information on their holdings to verify that they’re sticking to their investment strategy and aren’t doing well by dumb luck rather than by being smart. And every time a “genius” you’ve chosen makes a change to his or her portfolio, your portfolio automatically changes to match it.

If you choose to invest like a particular genius, KaChing charges a management fee that’s low by mutual-fund standards–between .98 percent and 2 percent–and turns 75 percent of it over to the “genius.” There’s a $3,000 minimum to participate.

KaChing founder Dan Carroll told me that KaChing is aimed at investors who’d otherwise sock money away in mutual funds, but who want more information on how their money is working for them than the mutual fund industry provides. He says that ratings systems such as Morningstar focus too much on past performance even though it’s not a good predictor of future results, and that the information provided by mutual fund managers in materials such as quarterly statements isn’t sufficiently detailed or timely.

Rightly or wrongly, many investors may have more confidence in venerable institutions such as Fidelity and Vanguard than in a little-known startup such as KaChing. I asked Carroll what would happen if KaChing ran into trouble: He told me that KaChing brokerage accounts are really with Interactive Brokers, a large outfit that’s not very well known because it mostly deals with institutions, not individuals. If anything were to happen to KaChing, members’ accounts would still be safe with the brokerage, he said.

KaChing’s an interesting idea (although not a wholly unique one–it’s a bit like social-investing Cake Financial, for instance). I’m intrigued enough to be flirting with the idea of signing up, even though I’m one of those garden-variety mutual fund investors who has my money with big-name funds and who likes to leave it there and forget about it. One reason I’m intrigued: One of KaChing’s investors and users is Marc Andreessen, cofounder of Netscape, OpsWare, and Ning. He’s a genius who needs no quote marks around the term, and while his involvement doesn’t make KaChing a sure thing, the fact he’s impressed is…impressive.

2 Comments

Read more:

0 Comments For This Post

2 Trackbacks For This Post

October 19th, 2009 at 9:38 am

[…] piggyback on the trades of “genius investors.” (NYTimes also New Rules of Investing, Technologizer earlier Abnormal […]

October 20th, 2009 at 8:39 am

[…] piggyback on the trades of “genius investors.” (NYTimes also New Rules of Investing, Technologizer earlier Abnormal […]